What is an allowance for doubtful receivables?

An allowance for doubtful debt is an estimate of how much of the trade receivables balance of a business will become irrecoverable in the next accounting period. It is exactly what it sounds like, an allowance for debts which are considered doubtful. An allowance for doubtful debt can be either a specific debt which is suspected will go unpaid, or a more general allowance based on a percentage of the total receivables. It could also be a fixed amount set by the organisation in question.

Why might we need one?

The allowance is a means of adjusting the trade receivables figure shown on the statement of financial position into a more ‘realistic’ figure. The application of the allowance for doubtful debt ensures that financial statements are created in accordance with the accounting principle of prudence.

How do we create one in the general ledger?

Any allowance for doubtful debt entry in the general ledger only ever includes 2 general ledger accounts. These are:

- Allowance for Doubtful Debt

- Allowance for Doubtful Debt: Adjustment

The allowance for doubtful debt account is the account which shows the total allowance we have estimated for the period. The adjustment account is where we record any changes we have made to the allowance in an accounting period (increase/decrease/creation/removal).

The general rule is:

- Allowance for doubtful debt is created and increased on the credit side of allowance for doubtful debt account

- The account is decreased or removed on the debit side of the account

The following case studies will demonstrate these points.

Case study 1 – creating an allowance for doubtful debt

Company XYZ has trade receivables totalling £200,000 at the end of the year, 31st December 20X6. It has been decided that an allowance for doubtful debt is to be created. This allowance will be 2.5% of the total trade receivables balance (after any irrecoverable debts are taken off).

£200,000 x 2.5% = £5,000 allowance required

The journal entry for creating this allowance for doubtful debt is as follows:

When entered into the general ledger, the accounts would look like this:

Case study 2 – increasing an existing allowance

The receivables for XYZ total £250,000 on 31 Dec 20X7. The allowance is still to be 2.5% of the receivable balance; the current allowance of £5,000 must therefore be adjusted to £6,250. The journal entry on 31st Dec 20X7 will be as follows:

When entered into the general ledger, the accounts would look like this:

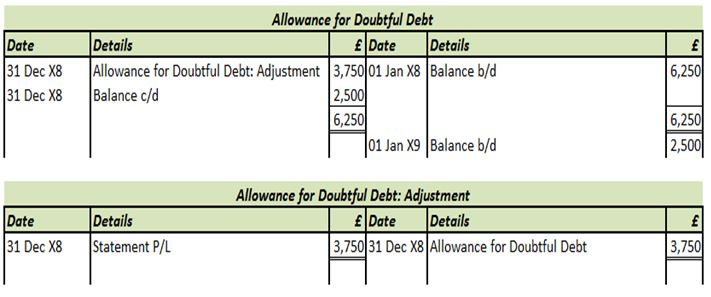

Case study 3 – decreasing an existing allowance

The receivables for XYZ total £100,000 on 31 Dec 20X8. The allowance is still to be 2.5% of the receivable balance; the current allowance of £6,250 must therefore be adjusted to £2,500. The journal entry on 31st Dec 20X8 will be as follows:

When entered into the general ledger, the accounts would look like this:

Where does the allowance for doubtful debts appear on the financial statements of a business?

The allowance for doubtful debts appears on the statement of financial position as an adjustment to the total trade receivables account (sales ledger control account). The trade receivables balance shown as a current asset on the statement of financial position will be the total balance less the allowance for doubtful debts. The account in the general ledger is simply balanced off at the end of each financial period (month/quarter/year) and brought down into the next period.

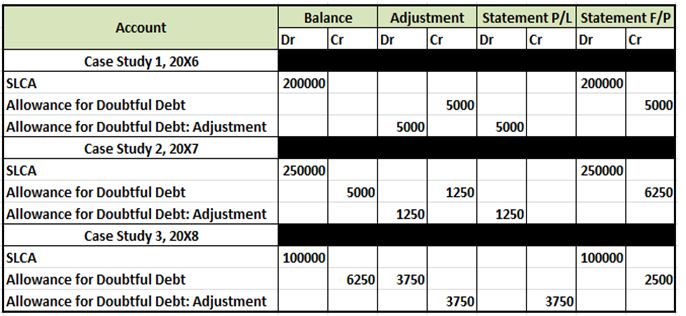

The adjustment account is transferred to the statement of profit or loss at the end of each period. The adjustment is either an expense to the business or an income to the business depending on the adjustment made. Looking at the 3 case studies in this article, the general ledger account for doubtful debt adjustment would look like this for the 3 years:

The ledger accounts demonstrate that in years 20X6 and 20X7 the adjustments made will be treat as an expense on the statement of profit or loss. This is because the adjustments in these years will reduce profit. In 20X8 the adjustment which reduces the allowance will be treat as an ‘other income’ on the statement of P/L as it will increase profit.

Think about this logically, in 20X6 and 20X7 the business is making an allowance for customers who might not pay us, this is obviously an adverse decision in terms of profit/loss and therefore an expense. In 20X8 we are making an adjustment which is reducing this ‘worst case scenario’ which is a favourable adjustment and one which will increase the profitability of the business.

The extracts from extended trial balance of XYZ for the 3 years would look like this:

How to remember which side to Debit/Credit

One way of remembering which account to debit/credit, always start off with the allowance for doubtful debt account. The account will always have a credit balance (the opposite to the trade receivables balance) so using a logical approach, an increase to the allowance must be a credit and the opposite for a decrease. Once you have decided what you’re doing with the allowance for doubtful debt account then using the basic principle of double entry, the opposite debit/credit entry must occur in the adjustment account.

Key points

- The adjustment account records any changes to the overall allowance, it is this figure which is transferred to the statement P/L

- The allowance itself is subtracted from the trade receivables (SLCA) balance, the adjusted balance is shown on the statement of financial position

- An increase to the allowance is always a credit in the allowance account, a debit in the adjustment account

- A decrease is always a debit in the allowance account, a credit in the adjustment account

- Allowances can be based on a percentage of the overall trade receivables balance, a fixed amount set by the organisation or can be based on a specific debt

To access your eLearning tools click the image below and login

Mathew Pickering is an AAT lecturer at The Sheffield College, part of the team which won Training Provider of the year (medium size provider) in 2015.