FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland deals with the issue of property, plant and equipment in Section 17 Property, Plant and Equipment.

FRS 102, Section 17 allows an entity to measure items of property, plant and equipment under the cost model (cost less depreciation less impairment) or under the revaluation model.

There is a separate section of FRS 102 which deals exclusively with investment property – that of Section 16 Investment Property. This article will examine the provisions of both Section 16 and Section 17.

Investment property

Investment property is property that is held to earn rentals or for capital appreciation or both (it is not owner-occupied property). Investment property can be land, or buildings (or part of a building) or both.

FRS 102 (March 2018), Section 16, does not contain any undue cost or effort exemptions. This means that all property which meets the definition of investment property per the Glossary to FRS 102 must be remeasured to fair value at each reporting date. There is an accounting policy choice which applies to investment property rented out to another group member which is examined in the next section of the article.

FRS 102 (March 2018) is mandatory for accounting periods commencing on or after 1 January 2019. Early adoption is permissible. There are only two amendments arising from the triennial review which can be early adopted separately without having to early adopt FRS 102 (March 2018) which relates to directors’ loans (FRS 102 (March 2018), paragraph 11.13A) and the tax effects of gift aid payments (FRS 102 (March 2018), paragraph 29.14A).

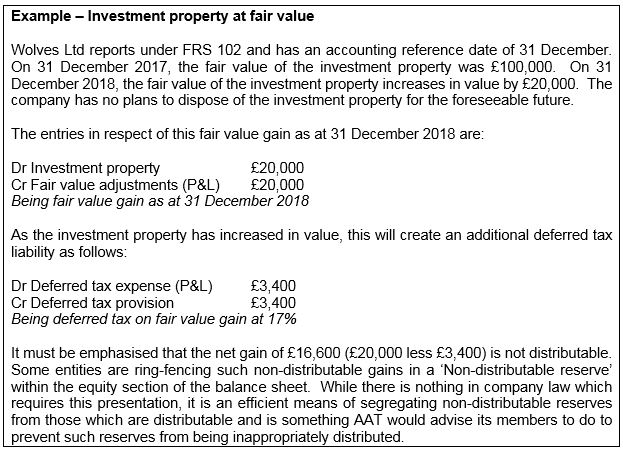

Under FRS 102, investment properties are accounted for using the fair value accounting rules in the Companies Act 2006, meaning that fair value gains and losses are taken directly to the profit and loss account. Fair value gains and losses must not be taken to a revaluation reserve as the Alternative Accounting Rules in the Companies Act 2006 are not being applied where investment properties are concerned. AAT Licensed Accountants and members working for companies dealing with such properties must understand the different accounting treatments under FRS 102 for fair value gains and losses for such properties. The example below shows how the double-entry works.

In addition, deferred tax must also be brought into account to comply with the requirements of paragraph 29.16 of FRS 102. Deferred tax which relates to investment property measured at fair value is calculated using the tax rates and allowances that apply to the sale of the asset. In practice, if the entity is not planning on disposing the investment property for the foreseeable future, we would currently use a rate of 17% (being the corporation tax rate which will apply on 1 April 2020). A common error where this calculation is concerned is to use the rate of tax which is in force at the balance sheet date.

As fair value adjustments for investment property go to the profit and loss account, the associated deferred tax consequences are also presented in the profit and loss account (ie within the tax expense).

Investment property in a group

As noted in the introductory paragraph of this section, the FRC have introduced an accounting policy choice which can be found in FRS 102 (March 2018), paragraph 16.4A, which only applies to investment property rented to a group member whereby the entity can apply a choice of accounting as follows:

- at fair value through profit and loss; or

- at cost.

This accounting policy choice only applies to groups (it does not apply to standalone entities with investment property, nor does it apply simply because the company is small). The accounting policy choice is in place of the undue cost or effort exemption which was removed from Section 16 by the FRC and effectively restores the position for groups in previous UK GAAP.

It is likely that properties rented to other group members will be accounted for at cost and where this is the case, the group applies the cost model in Section 17 Property, Plant and Equipment to measure the investment property at cost less depreciation and impairment losses.

If a group wishes to take advantage of this accounting policy choice and measure investment property rented to another group member at cost, then they will need to freeze the valuation of the investment property at the date of transition to FRS 102 (March 2018), which will be 1 January 2017 for a 31 December 2018 year-end; restate the comparative year and then account for the property under the cost model. This is because essentially the company owning the investment property has changed the accounting policy for measuring its intra-group investment property and changes in accounting policy are accounted for retrospectively.

It should be noted that if the group wishes to early adopt the accounting policy choice in FRS 102 (March 2018), paragraph 16.4A, then it must apply the whole of FRS 102 (March 2018) at the same time. The accounting policy choice is not available for early adoption on its own.

Property, plant and equipment

As noted in the introductory section of the article, property, plant and equipment (PPE) is accounted for under Section 17 of FRS 102 Property, Plant and Equipment. Section 17 allows PPE to be measured under the cost model or the revaluation model. Application of the revaluation model is an accounting policy choice and where the entity chooses to measure assets at revaluation, all assets within that asset class must be revalued. For example, if an entity owns four properties, it must revalue all four properties – it cannot just revalue those properties which the entity knows have appreciated (increased) in value, which is why the ‘all or nothing’ rule was introduced.

The revaluation model in Section 17 applies the Alternative Accounting Rules in the Companies Act 2006. Therefore, revaluation gains are taken to the revaluation reserve (in the same way as they were in previous UK GAAP). Revaluation losses are also taken to the revaluation reserve to the extent of a revaluation surplus in respect of the same asset; any excess loss is then taken to profit and loss. If the asset subsequently increases in value, the increase is recognised in profit or loss to the extent of the previously recognised loss, with the balance being recognised in the revaluation reserve.

When a company decides to use the revaluation model, it restates the asset(s) to fair value at the date of the revaluation. Further revaluation exercises must be carried out with ‘sufficient regularity’ to ensure the asset(s) carrying amount in the financial statements does not differ materially from its fair value at the balance sheet date. FRS 102 does not prescribe set timescales for revaluation exercises to be undertaken; hence, this will be left to management’s professional judgement.

Deferred tax consequences will also apply to an item of PPE subject to the revaluation model under the timing difference approach in Section 29 Income Tax of FRS 102. Where a revaluation gain occurs, this will create a deferred tax liability which is recognised in the revaluation reserve and reported through other comprehensive income. Keep in mind that the concept of the revaluation reserve still applies to PPE measured at revaluation under Section 17 – it has only been removed for investment property measured at fair value under Section 16.

Conclusion

The important points to highlight to AAT Licensed Accountants are the different accounting treatments for investment property and property, plant and equipment under FRS 102.

Investment property measured at fair value applies the fair value accounting rules in the Companies Act 2006 and hence are taken directly to the profit and loss account (not a revaluation reserve), as too are the deferred tax consequences – net gains are not distributable to the shareholders.

Property, plant and equipment measured at revaluation applies the alternative accounting rules in the Companies Act 2006 and hence are taken to the revaluation reserve together with the deferred tax consequences.

Steve Collings is the audit and technical partner at Leavitt Walmsley Associates Ltd.